Mid-Term Cancellations

Spot Coverage Gaps Before Anyone Else

When a commercial auto policy is canceled mid-term, the clock starts ticking. Carrier IQ shows you these coverage gaps in real time—so you can step in with a solution before carriers fall out of compliance or your competitors catch on.

Why Mid-Term Cancellations Matter

A mid-term cancellation is more than a data point—it’s a buying signal. Whether it’s due to non-payment, a compliance issue, or a change in operations, these carriers are at risk—and they often need insurance immediately to stay on the road.

Carrier IQ gives you real-time visibility into these urgent events, helping you quote faster, build trust quickly, and close the deal while competitors are still in the dark.

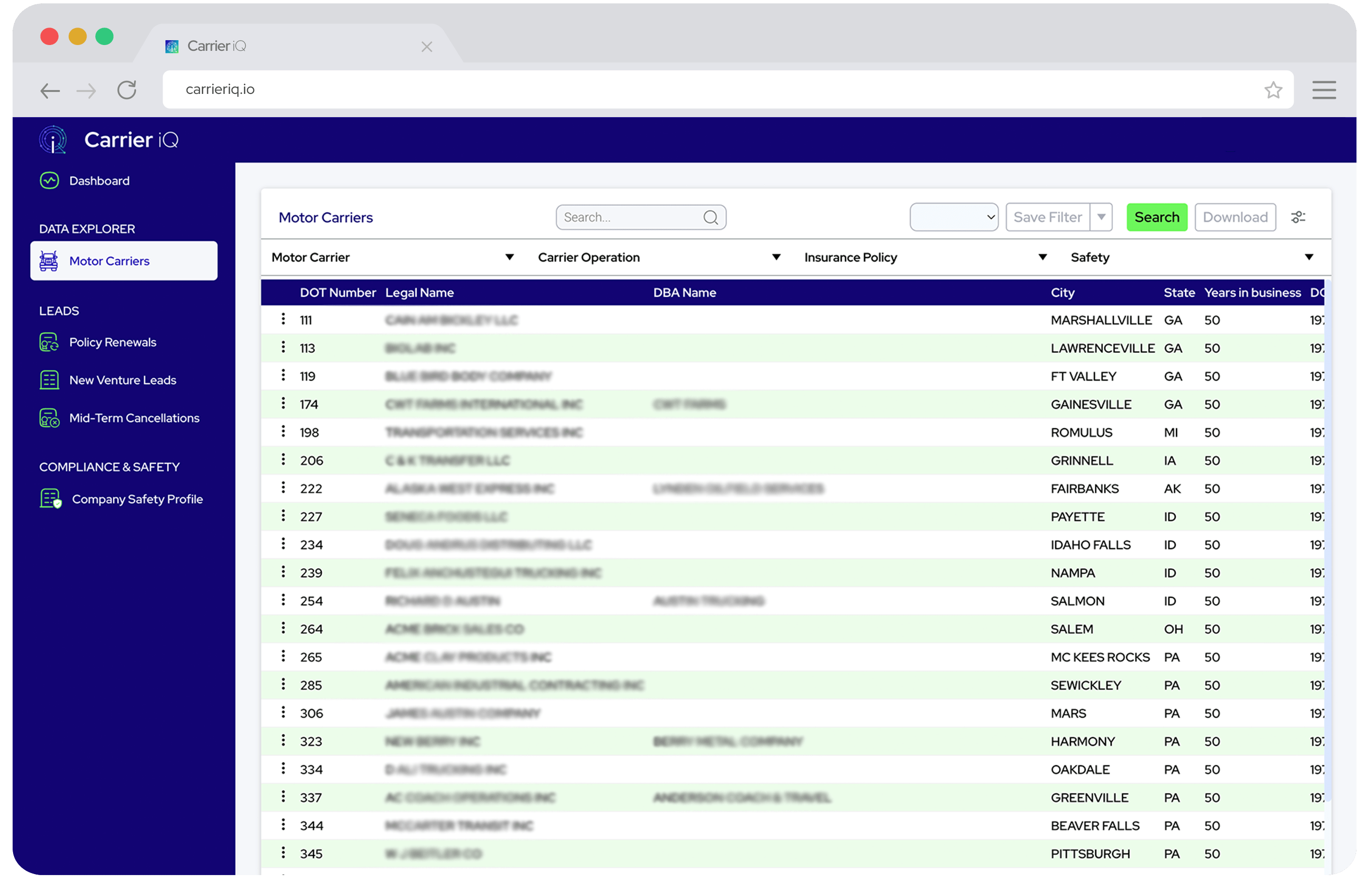

What You’ll See

-

Date of cancellation – Know exactly when coverage lapsed

-

Carrier name & DOT – Reach out with confidence and context

-

Fleet size & cargo type – Align outreach to your underwriting criteria

-

Operating authority status – Quickly assess urgency and risk

-

Geographic filters – Focus prospecting by state or region

-

And so much more!

This is live, FMCSA-backed data—updated continuously—so you can act while the opportunity is hot.

Why Choose Carrier IQ for Mid-Term Cancellations?

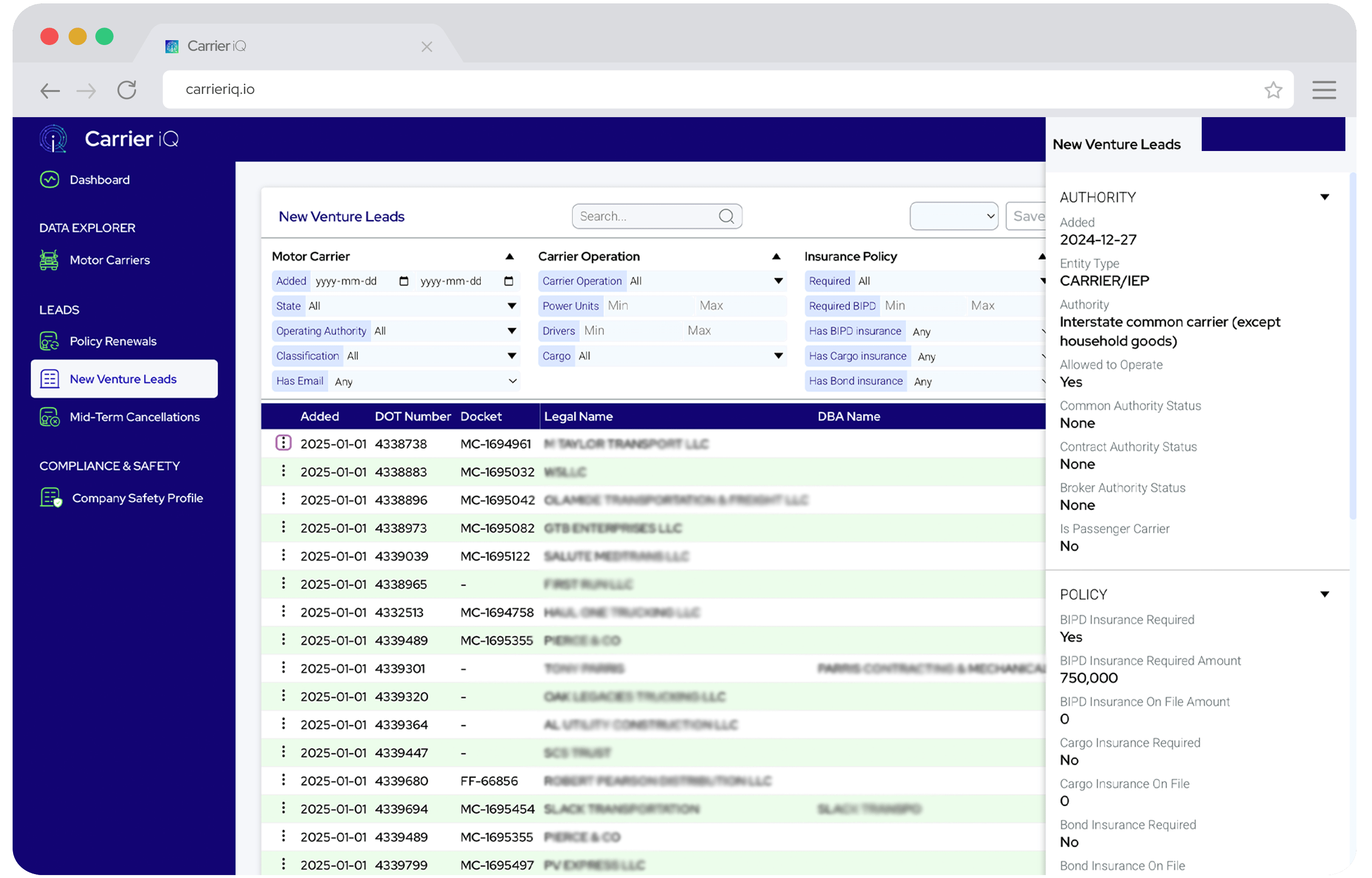

Instantly find the best carriers with accurate, up-to-date data.

Real-Time Cancellation Alerts

Other tools take days or weeks to catch up. We track mid-term policy drops as they happen—so you’re always first to respond.

Focus on the Right Opportunities

Filter by geography, fleet size, authority type, and cargo classification to target only the carriers that match your appetite.

Automated Alerts, No Manual Work

Set your filters once—we’ll send verified cancellations straight to your inbox daily or weekly. No digging. No spreadsheets. No wasted time.

Who It's Built For

-

Independent Agents

Get to the account before it’s flagged by competitors.

-

Producers

Drive high-close-rate activity with short-cycle opportunities.

-

Agency OwnersFill your pipeline with urgent, high-intent prospects—without adding headcount.