Credit & Risk Teams

Validating carriers before funding

Carrier IQ helps trucking factoring companies validate authority, detect risk changes, and avoid funding exposure using real-time carrier data.

Static carrier checks create blind spots. A carrier can lose authority, add risky equipment, experience compliance changes, and become higher risk overnight.

Carrier IQ surfaces these changes as they happen, so factoring teams don’t rely on outdated snapshots when advancing funds.

Before funding an invoice, factoring teams need quick, reliable answers:

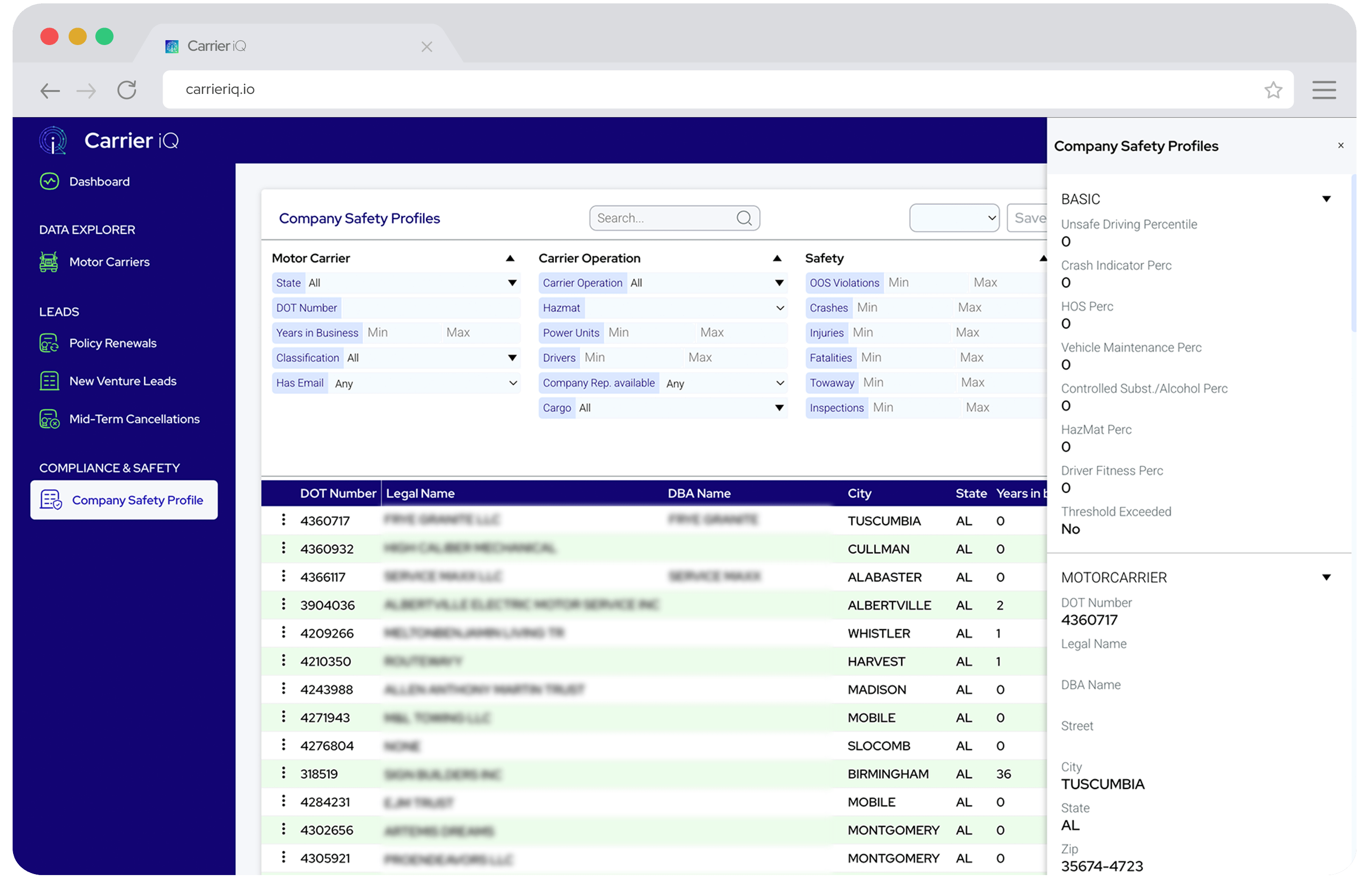

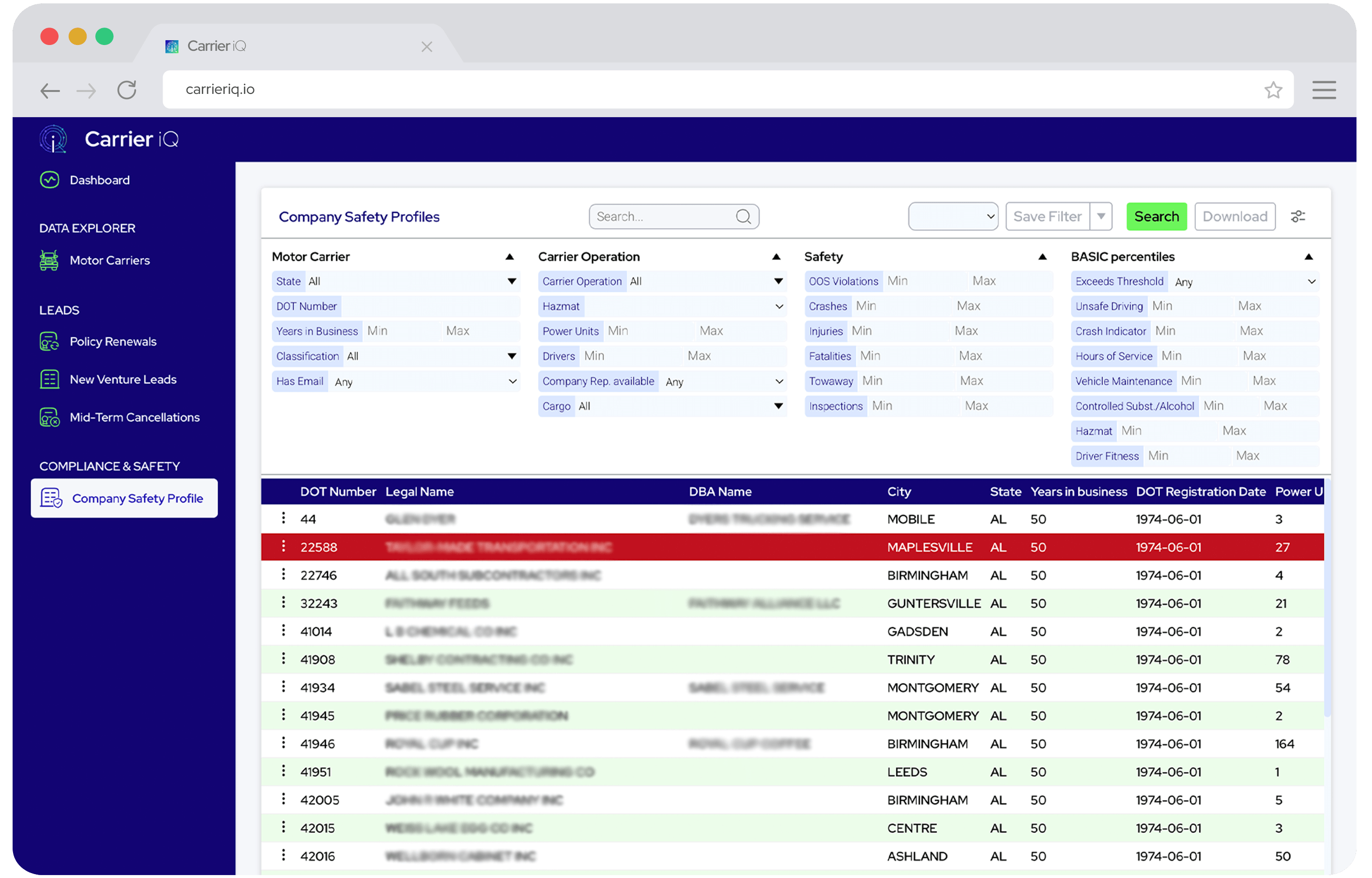

Carrier IQ surfaces carrier status and compliance signals as they change, helping factoring teams verify carriers without relying on manual FMCSA lookups or outdated reports.

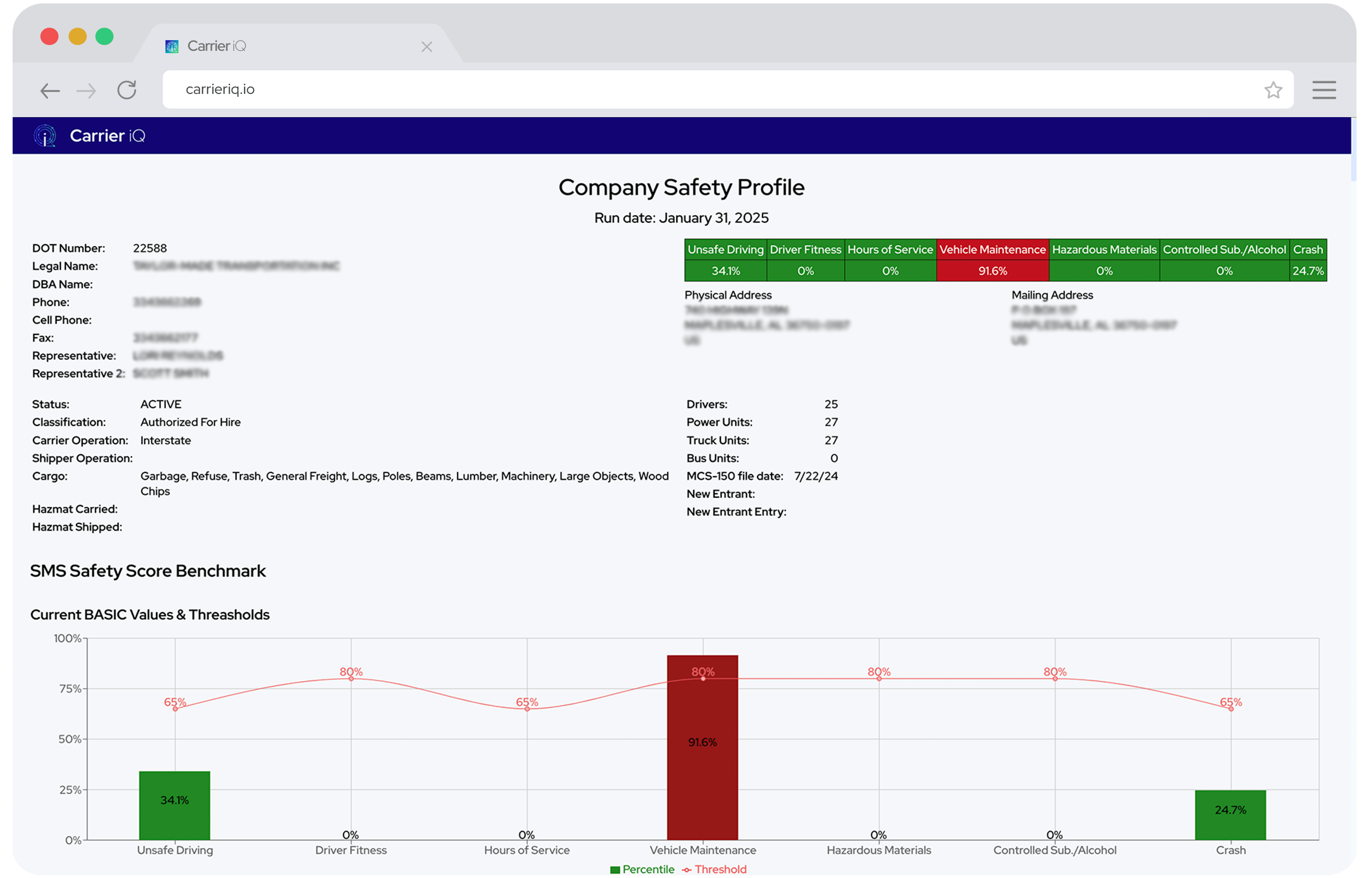

Factoring companies rely on carrier data to evaluate operational stability and financial risk.

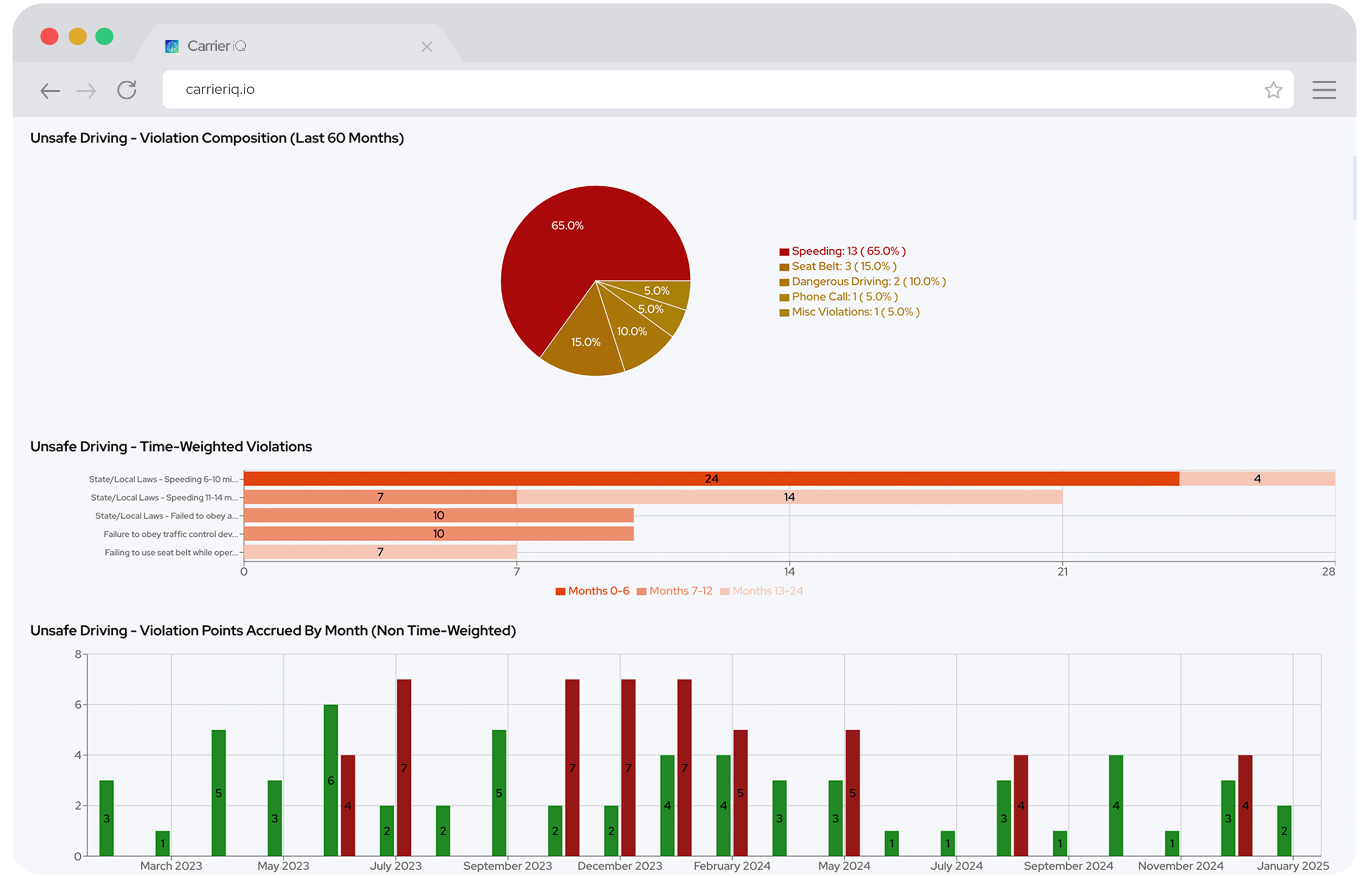

Carrier IQ provides visibility into key carrier signals, including:

This helps factoring teams make faster, more informed funding decisions — especially when working with owner-operators and small to mid-sized fleets.

Fraud and double brokering continue to create exposure across the trucking industry.

Carrier IQ helps freight factoring teams reduce risk by providing insight into:

This added layer of carrier intelligence helps teams avoid funding carriers that don’t meet internal risk standards.

Carrier risk doesn’t end once funds are advanced.

Carrier IQ allows funding teams to monitor carriers for changes that may impact repayment risk, including:

Instead of reacting after issues surface, teams can stay informed as carrier conditions change.

Validating carriers before funding

Monitoring active carriers for changes

Reducing fraud and funding exposure

Carrier IQ is not a factoring or lending platform — and that’s intentional.

We don’t provide funding, invoicing tools, telematics, or GPS tracking.

Carrier IQ is a carrier intelligence platform that delivers real-time visibility into motor carrier data used to support verification, risk assessment, and ongoing monitoring workflows.