FMCSA Data and Trucking Insurance Dynamics

Analysis of FMCSA Register Statistics

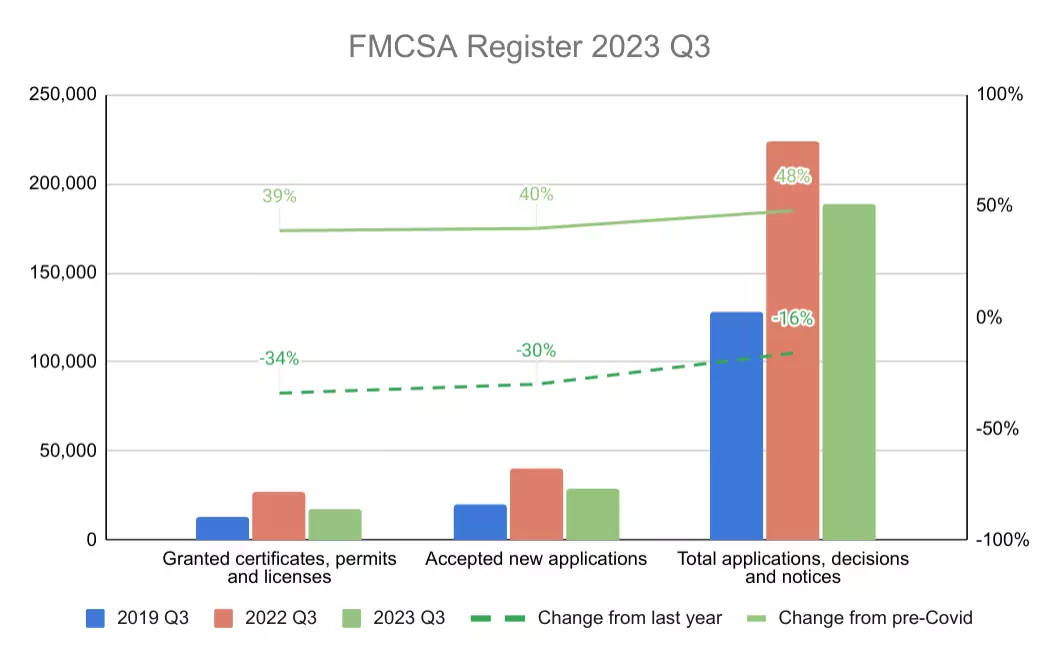

Overview of FMCSA 2023 Q3 Data:

- Granted Certificates, Permits, and Licenses: There has been a noticeable decrease in 2023, with 17,679 granted compared to 26,691 in 2022 Q3, marking a 34% drop.

- Accepted New Applications: The number has declined from 40,545 in 2022 Q3 to 28,404 in 2023 Q3, a 30% decrease.

- Total Applications, Decisions, and Notices: The total count has reduced to 188,776 from 223,872 in the previous year, indicating a 16% decrease.

Comparison with Pre-Covid Numbers:

- Compared to 2019 Q3, there is a significant rise, with a 39% increase in granted certificates, a 40% increase in new applications, and a 48% increase in total applications, decisions, and notices. This suggests a robust recovery post-Covid, but with a recent downturn in growth.

Implications for Commercial Insurance Trends

Impact on Trucking Insurance:

- The reduction in new certificates and licenses could imply a contraction in the number of new entrants in the trucking industry. For insurance agencies, this might mean a smaller pool of new clients seeking trucking insurance.

- However, the overall growth since pre-Covid times indicates an expanding market. Insurance agencies could find opportunities in offering tailored insurance products to these growing businesses.

Changing Risk Profiles:

- The fluctuating numbers suggest changing risk profiles in the trucking industry. Insurance agencies might need to adjust their risk assessment models to accommodate these changes, potentially impacting premiums and coverage terms.

New Ventures and Renewal Leads:

- The data also highlights potential for new venture leads. Insurance agencies can leverage this information to target emerging trucking companies that are navigating the post-Covid landscape.

- For insurance renewal leads, the increased numbers since pre-Covid suggest a larger base of existing businesses that may be looking to renew or upgrade their insurance policies.

Safety Profile Considerations:

- With the dynamic landscape, understanding and assessing the safety profiles of carriers becomes more critical. Insurance providers may need to focus more on comprehensive safety evaluations to mitigate risks effectively.

Need for Customized Insurance Solutions:

- As the trucking industry evolves, there is a growing need for more customized insurance solutions. Agencies can capitalize on this by offering flexible and adaptable insurance products that meet the specific needs of different trucking companies.

Conclusion

The FMCSA data provides valuable insights for insurance agencies, particularly those involved in trucking insurance. While there is a recent downturn in new certificates and applications, the overall growth since pre-Covid times paints a picture of an industry that is still on a growth trajectory. This scenario presents both challenges and opportunities for commercial insurance providers. By understanding these trends and adapting their offerings accordingly, insurance agencies can better serve the trucking industry, offering more relevant and effective insurance solutions.